Corporate KYC refers to the verification process of businesses and related individuals to ensure regulatory compliance. Although financial institutions are the only organizations required to perform corporate KYC, any company can benefit from it, especially those that provide services to other businesses.

While standard Know Your Customer (KYC) focuses on verifying individuals, corporate KYC goes a step further by verifying businesses’ legitimacy. And there’s a great reason for that. Due to the rising threat of fraud, it’s no longer sufficient to depend only on verifying individuals interested in purchasing your service.

KYC measures have been a part of Anti-Money Laundering (AML) regulations for some time now. In practice, during KYC, the user must complete KYC before establishing any working relationship with a financial institution.

So to effectively safeguard your business, meet legal requirements, and mitigate fraud risks, it’s necessary to know how to authenticate every company you start a business relationship with. This process is called corporate KYC or Know Your Business (KYB).

Corporate KYC is an identity verification measure that authenticates the legitimacy of a business and its owners before they can open an account with a financial institution. According to AML regulations, obligated entities must undergo Politically Exposed Persons (PEPs) and sanctions screening processes during a company check.

The main elements of the corporate KYC process are:

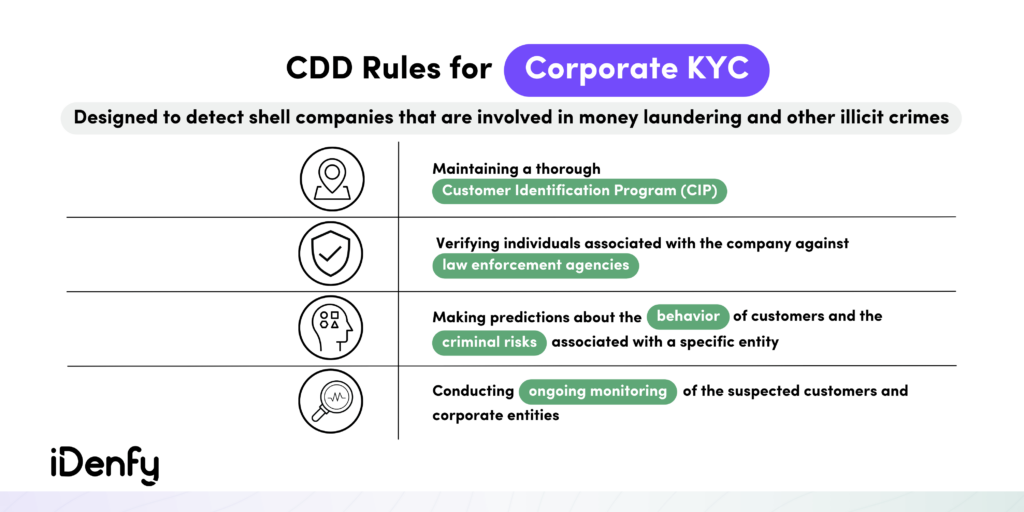

While financial institutions and related businesses such as fintech or cryptocurrency companies are legally required to perform corporate KYC, any company can use such background checks as a way to ensure security and build a more robust risk management strategy.

Corporate KYC is crucial because it helps companies verify the identities of their clients, especially other corporations. It’s an integral part of the onboarding process, where a company takes measures to prevent fraud and detect any risks associated with another company or customer.

Moreover, the evolving regulatory landscape is increasing the demand for corporate KYC compliance. As more processes come under the AML scrutiny and penalties become more severe, alongside customers’ growing concerns for data privacy, companies must also ensure the safety and security of their B2B relationships.

Regarding compliance, the Corporate KYC term is relatively new, especially compared to the more established practice of conducting customer KYC identity checks. For many years, there was a security gap because of the lack of AML measures dedicated to business relationships.

To fight the infiltration of Pablo Escobar’s drug enterprise into the global banking system, G7 presented the Financial Action Task Force (FATF) in 1989. And after the 9/11 attack, the FATF expanded its agenda to include anti-terrorist funding, which safeguards the global financial system from criminal activity.

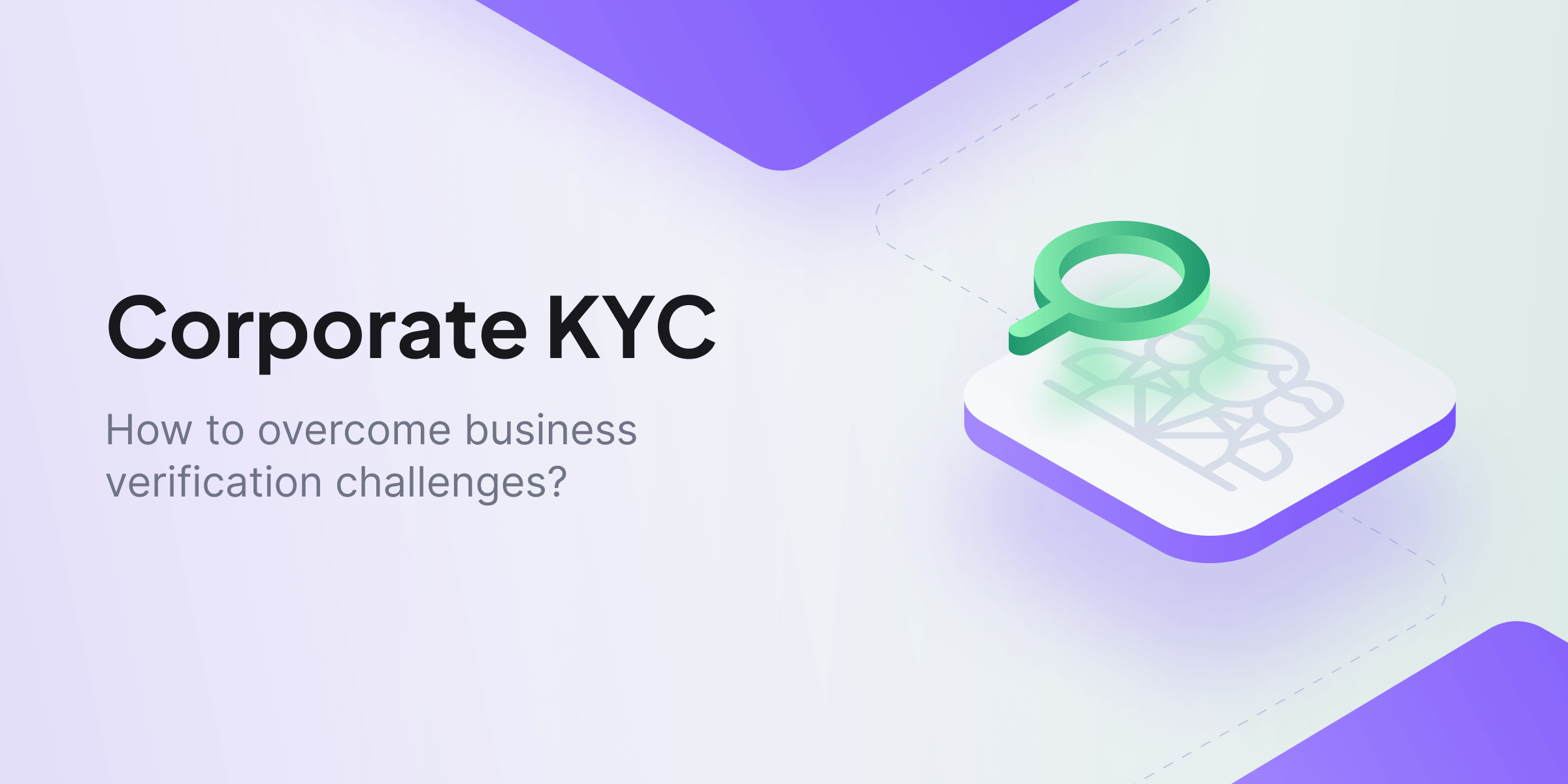

Fast-forward to 2016, the US Financial Crimes Enforcement Network (FinCEN) introduced new regulations under the CDD rules to combat this issue further, requiring any company engaging in business with another business to follow a standardized process of verifying the legitimacy of another company. This is known as corporate KYC or KYB.

Before more rigorous regulations, criminals exploited this loophole by setting up shell companies to conceal their identities. As business records were only superficially reviewed, fraudsters could launder money, finance terrorism and commit other types of fraud without undergoing screening, not to mention leaving a single mark behind.

All businesses that fall under regulatory compliance must take steps to prevent themselves from being involved in money laundering or related illegal activities. Even if a business is not formally required to perform corporate KYC checks, facilitating criminal activity is dangerous, not to mention illegal.

Three key factors illustrate companies benefiting from corporate KYC:

Under the law, banks, financial companies, and other entities that engage with them, including crypto and fintech players, must carry out corporate KYC checks.

Certain regulations are limited to specific countries, while other measures are more universal, such as requiring all companies to steer clear of conducting business with risky entities, such as companies found on the sanctions lists.

To streamline the collection of documents and save time, businesses may use a standardized certification form or an automated platform from a third-party compliance service provider to gather the required information. Since there are no strict guidelines on how exactly corporate KYC checks should be done, companies can employ alternative methods.

Corporate KYC regulations oblige companies to:

Additionally, to ensure the legitimacy of a company, you can request and check other documents. They should disclose official information, such as the company’s valid business name and address, proof of incorporation or registration, and details about its ownership structure. By verifying these data points, you can ensure that the company you’re dealing with is reputable and trustworthy.

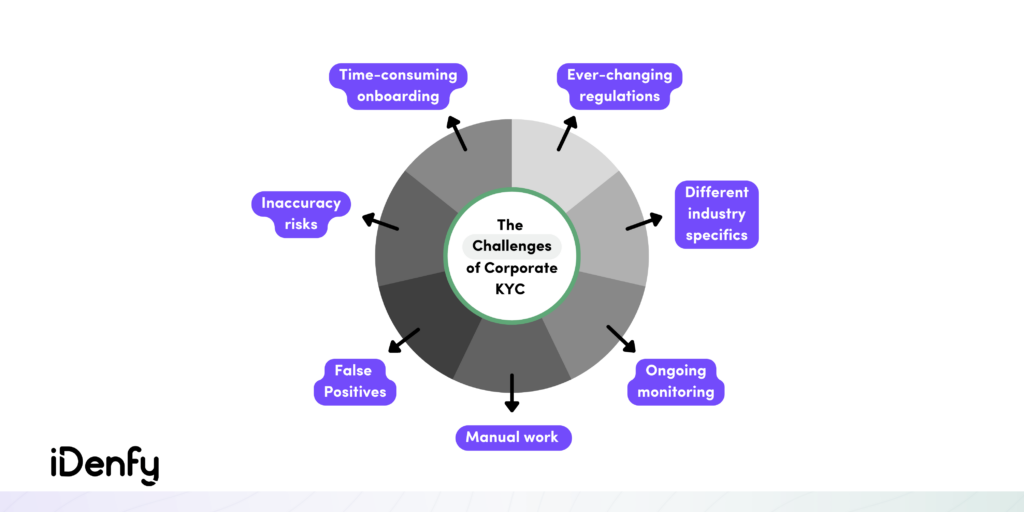

One of the primary difficulties businesses face is the sheer volume of information that needs to be collected and verified. That’s why corporate KYC can be time-consuming and resource-intensive, especially for companies with numerous business partners because:

Maintaining the latest legal requirements can also be a major hassle as compliance regulations constantly evolve. So even the slightest mistake or discrepancy can lead to serious consequences. Finally, businesses must balance the need for thorough corporate KYC checks with the desire to provide a frictionless experience, as overly complex processes can lead to customer dissatisfaction.

The initial phase of the corporate KYC check involves verifying that the business exists and operates within the confines of the law. This provides confidence to the company conducting the corporate KYC check that their potential partner’s financial dealings are legitimate.

After ensuring that the business is legitimate and worthy of collaboration, it’s necessary to conduct a background check on the individuals behind it. This process helps ascertain that they are law-abiding individuals, minimizing the risk of legal or reputational issues.

Other important tips that’ll help businesses conduct corporate KYC checks include:

Without the help of technology and automation, corporate KYC can be complex. It requires companies to complete a substantial amount of paperwork and do the whole background check on the company and its shareholders.

So why all this hassle? You can use a fully automated platform to simplify Corporate KYC checks. iDenfy’s Business Verification solution enables companies to onboard corporate entities faster by collecting the information for you, including conducting automated AML checks, identifying and verifying UBOs, and screening against watchlists and sanctions lists.

iDenfy’s corporate KYC platform builds a streamlined process to onboard companies quickly, with all necessary features in one place. The platform includes custom automation rules, the ability to order and receive government register reports, and other essential tools.

Book a demo or contact us to learn how this automated approach can save you time and effort.