You already know that it’s difficult to be an employer in the state of California. In fact, if you’re a California employer, you’re probably sick and tired of people telling you how difficult it is to be an employer in the Golden State.

Let’s flip that soggy old narrative on its head and, instead, focus on one way to make your life easier as a California employer. What? That’s right…California…employer…life… easier . Keep reading and take the California Wage Notice off the list of things that haunt you…

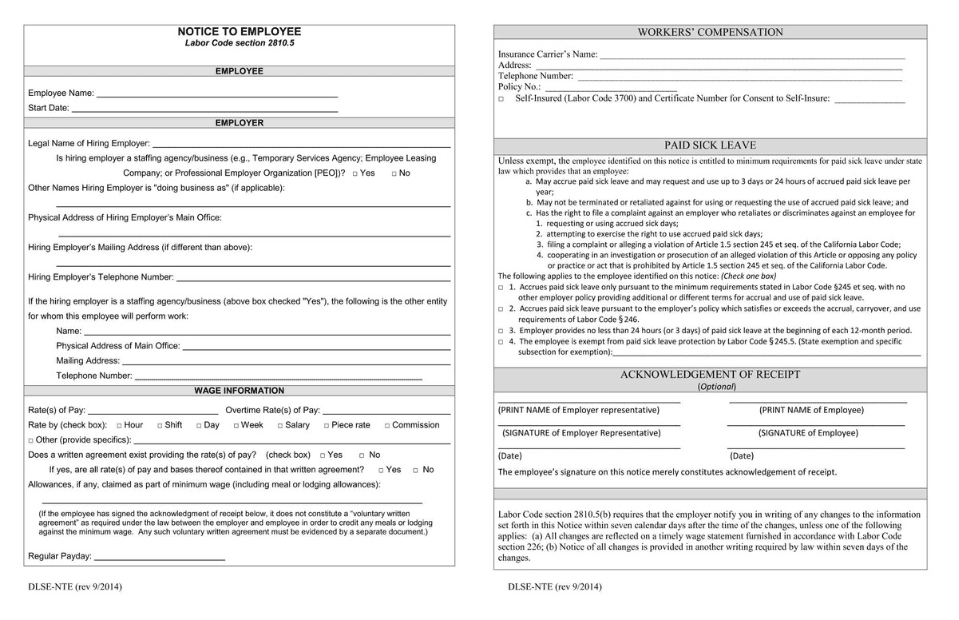

The California wage notice is a tricky little form that has been required in all private workplaces since 2011. At first blush, the form looks like a breeze – you just fill in the blanks! In our experience with employers over the years, there are quite a few areas that cause both confusion and compliance concerns. We’ll share what we’ve learned with you below.

The notice is required under California’s Wage Theft Protection Act of 2011 . That law says that all private employers must give workers specific information about their employment. If your office is ever audited by the Labor Commissioner, current and accurate notices are one of the items the auditor will look for, so it’s best practice to keep them up-to-date and on-hand at all times.

All non-exempt employees (those subject to minimum wage and overtime requirements) must receive a notice.

Employees must receive the Wage Notice at the time of hire , so be sure to include the wage notice as part of your new hire paperwork. CEDR’s New Hire Checklist for California employers includes a link to the wage notice so you will never forget (CEDR Members can find this in their Members Area). In addition, employers must update the wage notice within seven calendar days of any changes to the information contained in the notice.

What’s so hard about an employer name? This can actually be a complicated piece of information. Many businesses use a “DBA” (doing business as) name that is different from the legal business name. Your legal business name includes a business entity designation such as “Inc.,” “LLC,” or “Corp.”

For example, if your business is commonly known as “Desert Family Medicine”, but your legal entity name is “Dr. Diego Kahlo, M.D., L.L.C.”, the Wage Notice should read: “Dr. Diego Kahlo, M.D., L.L.C., dba Desert Family Medicine.”

Overtime is simply 1.5x the regular rate of pay, right? Nope. Many employers read the “Overtime” part of the wage notice and simply write “x 1.5.” However, the California Labor Code is very clear that 1.5 is the multiplier for overtime, but this figure does not meet the requirement for listing the overtime rate itself .

If your employee’s regular rate of pay is $20.00 per hour, the overtime rate on the wage notice must be listed as $30.00 per hour.

If you’ve read enough of CEDR’s other materials on overtime rates of pay , you know that overtime is impacted by a variety of factors, such as an earned bonus. The wage notice only requires you to list known overtime rates and allows you to state that the listed rate is subject to upward adjustments based on other forms of compensation.

Since the implementation of statewide sick leave requirements in 2015, the wage notice has required employers to tell their employees how they are receiving sick timeٰٰٰٰ. The Paid Sick Leave section of the wage notice is an area of common confusion for employers – many employers I speak with are not sure which box to check in this area.

Really, the essence of this question is: What type of paid sick leave policy do you have?

Box #1 is for employers who accrue (earn slowly over time) paid sick leave time at the state minimums.

Box #2 is for employers who are using an accrual policy but are accruing time in excess of the state minimum requirements (for example, allowing for faster accrual, or for an accrual of a greater amount of sick leave time).

Box #3 is for those employers who are not accruing time but have chosen to “front load” the sick leave time at the beginning of the benefit year instead.

Box #4 is for employers who are exempt from state sick leave requirements (i.e. probably not you).

It might seem like just one more HR headache for California employers but, with the proper guidance, completing the California Wage Notice Form for new hires shouldn’t cause you to lose any sleep. And, now that you know the basics with respect to what goes into that document, we hope you’ll be able to rest easier the next time you onboard an employee.

California Wage Notice Form

This post authored by Solution Center Manager Grace Godlasky.

[1] If you are not already familiar with your paid sick leave obligations in the state of California, contact us at support@cedrsolutions.com.

Friendly Disclaimer: This information is general in nature and is not intended to provide legal advice or replace individual guidance about a specific issue with an attorney or HR expert. The information on this page is general human resources guidance based on applicable local, state and/or federal U.S. employment law that is believed to be current as of the date of publication. Note that CEDR is not a law firm, and as the law is always changing, you should consult with a qualified attorney or HR expert who is familiar with all of the facts of your situation before making a decision about any human resources or employment law matter.

Get Started with the

Best HR Experts

Enter your email below to join the community of over 20,000 business professionals.